How Credit Unions Innovate

Using Crowdsourcing to Drive Innovation

Your first challenge free!

— Gijs van Wulfen

The Three Pillars of Credit Union Innovation

According to Filene Research Institute, credit union innovation isn’t just about deploying shiny new tech—it happens across a range of focus areas that truly move the needle. So, where do successful credit unions prioritize their efforts?

Rethinking Operations (Business Model Innovation)

This pillar is all about questioning how things get done behind the scenes, from how resources are allocated to the way teams work together and adapt their processes. The goal? Staying nimble while meeting the ever-changing needs of members.

Enhancing Offerings (Value Proposition Innovation)

Here, credit unions look at their suite of products and services—everything from checking accounts to mobile apps—and ask, “How can we deliver more value or stand out even more?” Tweaks and upgrades in this category can make the organization truly shine in a crowded marketplace.

Transforming Member Interactions (Member Experience Innovation)

The final piece centers on the member journey. Innovations here might include introducing new digital engagement channels, smoothing out in-branch experiences, or finding creative ways to personalize interactions. These efforts directly shape how members feel about their credit union, and that experience is more important than ever.

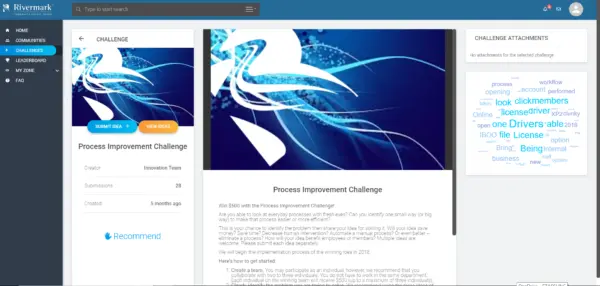

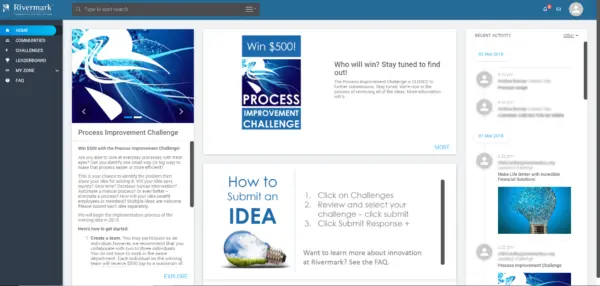

Rivermark Community Credit Union — A Leader in Crowdsourcing Innovation

7 Ways Credit Unions Innovate with Innovation Software [INFOGRAPHIC]

The beauty of innovation software is that it provides the framework for engaging innovation participants, vetting ideas, streamlining communication and encouraging collaboration, but there really are no limits on how it can be used. The software is designed to be flexible so that each user and credit union can design and implement their own path towards innovation. The infographic outlines seven popular ways that credit unions are using innovation software to pursue innovation.

Small Changes Offer a Big Impact

Capture, Evaluate and Implement

“Innovation” can sound like a lofty goal, but not all innovative ideas have to completely transform entire industries. Incremental changes in processes can yield significant benefits. Simply working more efficiently and effectively can reduce waste and cut expenses. Over time, these changes can produce significant savings that impact a credit union’s bottom line. The key is to be able to capture, evaluate and implement ideas from employees and others involved in the crowdsourcing process. Ezassi innovation software allows for all ideas, both big and small, to be captured and developed.

Thriving in a Competitive Environment