Innovating the Airlines, Aerospace, and Defense Industries

Navigate high-powered technologies and targeted research using Innovation Management Software.

HOW DOES AEROSPACE & DEFENSE INNOVATE?

Aerospace & Defense: An Economic Powerhouse

The aerospace and defense industry continues to be a driving force behind global economic growth. In recent years, its impact has only intensified—especially as emerging technologies accelerate new opportunities for commercial and government sectors alike.

According to the Aerospace Industries Association, the sector remains a significant contributor to the American economy, supporting millions of jobs, generating robust exports, and fueling technological leadership across states and countries. The ripple effect extends far beyond aircraft manufacturing; it empowers a diverse supply chain of small to large businesses, from engineering firms to advanced parts suppliers.

Engine Health Monitoring Systems

Launch Faster Innovation Solutions

Research Case Study

EU – US Trade and Technology Council (TTC) to Advance Secure and Trustworthy AI Technologies

Enhancing Customer Experience with AI in the Aerospace Aftermarket

SpaceX Strategy: From Commercial Space Exploration to National Security Defense Contracting

Global Events Impacting Aerospace and Defense Supply Chains

Space Exploration Partnerships & Projects

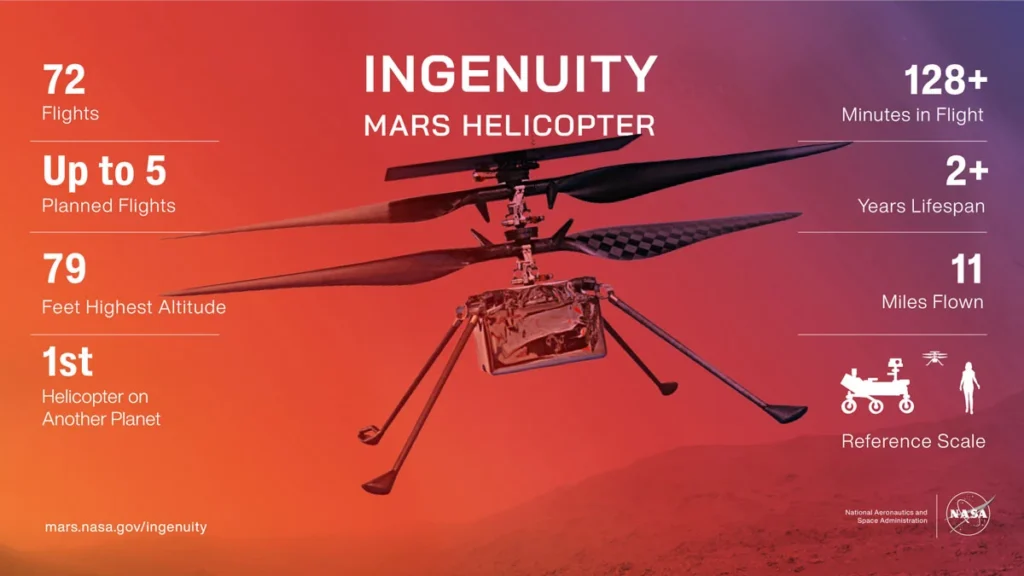

The Mars Ingenuity Helicopter was the first powered extraterrestrial aircraft. It concluded its mission on Jan. 18, 2024, due to damage to its rotor blade, ending a historic journey of aerial exploration on Mars. Originally designed for five flights, this 1.2-meter bladed aircraft with solar panel charged Lithium-ion batteries surpassed expectations, completing 72 aerial scouting flights over nearly three years. Its primary goal was a technology demonstration of powered flight on another planet, which it achieved as early as April 19, 2021. While on its mission it achieved new altitude and airspeed records on the Red Planet in the name of experimental flight testing for future space exploration. A dual carbon fiber rotor system for the next generation of Mars helicopters is currently being tested in the 25-foot space simulator at NASA’s Jet Propulsion Laboratory and has reached near supersonic speeds.

Transform Your Innovation Process

Companies aim to ignite an innovative culture and outperform the competition in today’s fast-paced market. Our tools provide the spark you need to inspire and align project teams, equip intrapreneurs for innovation, and help you lead in disruptive tech. Learn more by scheduling an introductory call with our Innovation Management experts!