How can organizations ensure they’re investing in the right mix of innovation projects? The answer lies in building a healthy innovation portfolio.

A well-structured innovation portfolio helps organizations balance risk and reward, align innovation efforts with strategic goals, and maximize the impact of their investments. By understanding what a healthy innovation portfolio looks like and how to manage it effectively businesses can drive sustainable growth, stay ahead of competitors, and future-proof their operations.

With today’s relentless pace of change, fierce global competition, and ever-rising market expectations, the ability to innovate is no longer a luxury—it’s a necessity for year-to-year viability. Management knows it, and so does Wall Street: organizations that fail to continually innovate risk falling behind or becoming obsolete. Building and maintaining a healthy innovation portfolio gives companies the agility and resilience needed to thrive, ensuring that today’s investments set the stage for tomorrow’s success.

What Is an Innovation Portfolio?

An innovation portfolio is a carefully curated collection of innovation projects, initiatives, or investments that an organization manages simultaneously. Much like a financial portfolio, its purpose is to diversify risk and optimize returns by balancing different types of innovation—ranging from incremental improvements to breakthrough, transformative ideas.

A healthy innovation portfolio doesn’t just focus on short-term wins or safe bets. Instead, it strategically distributes resources across projects with varying levels of risk, potential impact, and time horizons. This approach ensures that while some initiatives support the core business and deliver immediate value, others explore new markets or technologies that could drive future growth.

In essence, an innovation portfolio provides a holistic view of an organization’s innovation efforts, enabling leaders to make informed decisions, prioritize investments, and adapt to changing market conditions with agility and confidence.

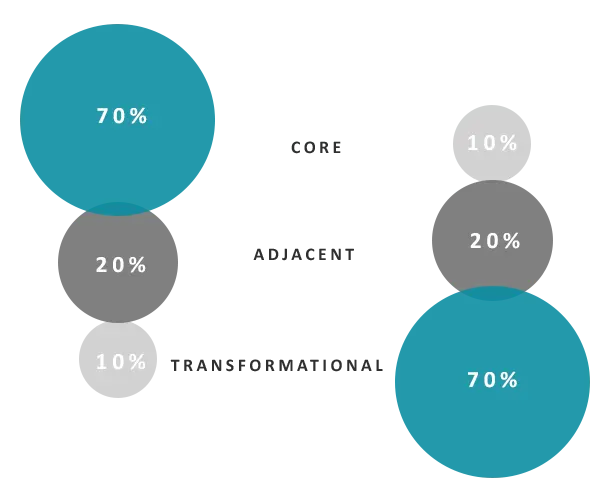

Harvard Business Review (HBR) published the article, Managing Your Innovation Portfolio. They found on average high-performing organizations focus 70% of their innovation resources on core or incremental offerings, 20% on adjacent offerings, and 10% on transformational initiatives. Even though the average was a 70:20:10 spread, they still reference other successful models depending on your industry and your level of ambition and allocations.

The biggest take-away from the HBR report and subsequent reports is that for an innovation program to be successful, the focus should be a mix of incremental (core), adjacent and transformational initiatives. This mix will enable a program to deliver results both in the near term and long term.

In addition to finding the right balance, organizations need to have the right resources to deliver. These include:

- Talent

- Integration

- Funding

- Pipeline Management

- Metrics

Inc. published the article, If You Want to Innovate –and Disrupt–Rethink the 70:20:10 Rule. In this article, Jeffrey Phillips looks at the factors that can impact this Rule, and while it may work for some, it will not work for industries looking to create breakthrough or disruptive innovation every 6-8 months.

Before we dive deeper into different rules and how your industry and innovation initiatives will impact your strategy, let’s review the types of innovation initiatives and the short/long-term return potential.

- Incremental/Core – largest investment, smallest potential long-term return

- Breakthrough/Adjacent – medium investment and potential long-term return

- Disruptive/Transformational – smallest investment, largest potential long-term return

Many leaders admit to feeling unsure and even frustrated when it comes to managing all the various innovation activities within their organizations. Often, there’s an awareness that a tremendous amount of innovation is happening, but it can seem scattered and difficult to track. The pursuit of the new may feel haphazard and episodic, raising concerns that the company’s total investment in innovation isn’t delivering the returns it should.

By understanding these categories—and recognizing the challenges in tracking and managing innovation efforts—you can begin to bring clarity and direction to your innovation portfolio. This clarity is essential for ensuring your investments are intentional, aligned with your goals, and positioned to deliver value both now and in the future.

For the short and long-term potential of an innovation portfolio, we’ll use the Three Horizons of Growth, created by McKinsey & Company. Today, some will argue that this model no longer applies, in that case, we will use it as a guide for prioritization.

- Horizon1: Core/Incremental 0-1 years (short-term)

- Horizon 2: Emerging/Adjacent 1-3 years (mid-term)

- Horizon 3: Disruptive/Transformational 3+ years (long-term)

70:20:10 Innovation Portfolio Model

Google CEO Eric Schmidt pioneered this model. With additional research, Google confirmed that the companies that followed this model typically outperform their peers by a margin of 10-20% (P/E ratio). They also concluded that the long-term returns for each type of investment are actually the inverse of the resources invested.

When we place innovation activities into three “horizons” (incremental, breakthrough, and disruptive), the general Rule of thumb is that most companies should be doing 70% incremental, 20% breakthrough, and 10% disruptive innovation. Note that this Rule of thumb assumes that innovation is ongoing and that other activities are underway, sometimes simultaneously.

85:10:5 Innovation Portfolio Model – “Risk Adverse”

For risk-averse organizations, the 85:10:5 model is more conservative. This model tends to work well for consumer goods companies. The most significant focus is on the core/incremental initiatives while allocating resources for both adjacent and transformational innovations. When considering this model, make sure it aligns with your long-term innovation goals.

55:30:15 Innovation Portfolio Model– “Risk Tolerant”

For organizations that are risk-tolerant, they may want a more aggressive 55:30:15 innovation portfolio model. This model focuses on the core/incremental initiatives but allocates more resources for adjacent innovations and focuses on transformational innovations. When considering this model, make sure it aligns with your long-term innovation goals.

40:40:20 Innovation Portfolio Model – “Disruptive Industries”

Disruptive organizations looking to be more aggressive than the risk-tolerant portfolio may want to consider a 40:40:20 innovation model. Technology companies who are striving for transformational innovations focus more of their resources on being disruptive. There is more risk with this model, but the industry has inherent risk. When considering this model, make sure it aligns with your long-term innovation goals.

Take, for example, the cell phone industry. Imagine trying to innovate with a 70% incremental goal when every other mobile phone manufacturer tries to create breakthroughs or disruptive innovations every 6-8 months. In slow and steady industries, a 70:20:10 investment model may make sense. In industries with a faster pace or more dynamic change, we may find a more aggressive investment strategy that makes more sense or some other investment strategy.

Beyond Frameworks: How Executive Decision-Making Really Works

Why Do Chief Executives Feel Uncertain About Innovation?

Even the most seasoned chief executives can find innovation a bit like herding cats. There’s often a dizzying array of projects, pilots, and prototypes cropping up in all corners of the company—everyone’s excited, but who’s steering the ship? As initiatives multiply and become scattered across different business units, executives frequently struggle to see the bigger picture.

This fragmentation leads to questions: Are resources being used wisely, or are teams accidentally reinventing the wheel? Is all this activity really adding up to a competitive edge—or just producing a patchwork of interesting but disconnected experiments? With so much energy devoted to innovation, leaders can’t help but wonder if the actual business impact matches the investment being poured in.

It’s no wonder, then, that many executives feel a nagging sense of uncertainty. They’re left trying to gauge not just whether enough is being done, but whether it’s being done in a coordinated and purposeful way.

While frameworks like the Three Horizons model offer valuable ways to map out innovation ambitions and stress-test your portfolio, executive leadership often prioritizes financial outcomes over theoretical balance. For most organizations, especially in today’s fast-paced and resource-constrained environment, decisions about which innovation projects to pursue are ultimately driven by hard business questions:

How much will this cost?

What’s the expected return?

How long until we see results?

How confident are we in this innovation’s success?

The reality is that the classic ratio approach is more of an intellectual exercise than a prescriptive rule. As innovation timelines compress- especially with the acceleration brought by AI- companies are less likely to follow rigid horizon allocations and more likely to dynamically shift resources based on real-time market conditions and projected ROI. The focus is on integrating innovation efforts to deliver measurable impact this year and next, rather than maintaining a perfect spread across horizons.

The Three Horizons Model can help build a common language and encourage big-picture thinking, but executive decisions are grounded in financial rigor and strategic fit. The most successful innovation portfolios are those that answer the core business questions (Cost, Expected Return, Timeline, Confidence Level) ensuring each initiative is not only visionary but also viable, timely, and aligned with the company’s financial goals.

Common Challenges in Overseeing Innovation Efforts

Many leaders find themselves navigating a fog when it comes to managing the sheer scope of innovation unfolding across their organizations. Even with pockets of creativity and numerous teams launching new initiatives, there’s often a persistent sense that the overall approach lacks cohesion. Innovation efforts can feel scattered rather than strategic—like a series of one-off experiments rather than a coordinated campaign.

This lack of visibility often leads to concerns that resources are being spread too thin or invested in projects that aren’t moving the company forward in a meaningful way. Leaders may wonder if their innovation investments are delivering strong enough returns or if promising ideas are lost amid competing priorities. Ultimately, the feeling is less about a lack of enthusiasm for innovation, and more about wanting to replace the chaos of disconnected projects with clarity, direction, and measurable results.

Navigating Executive Challenges in Proving Innovation Value

Despite the universal acknowledgment—from the boardroom to Wall Street—that ongoing innovation is essential for a company’s survival, many executive teams find themselves under pressure to provide tangible proof that their innovative initiatives will consistently deliver results. In today’s landscape, where investor expectations are sky-high and global competition is only intensifying, the burden to show dependable, measurable innovation outcomes is heavier than ever.

But here’s the rub: Executives often grapple with a sense of uncertainty when it comes to demonstrating the effectiveness of their innovation investments. Even if there’s a flurry of activity within the organization—skunkworks projects, new service pilots, or emergent product lines—leadership can feel disconnected from the details. This lack of visibility frequently leads to a perception that innovation efforts are scattered, lacking an overarching strategy or coordinated direction.

As a result, it becomes difficult to confidently address stakeholders’ and investors’ core questions:

- Are these initiatives progressing toward commercial success?

- Will today’s bets on innovation yield sustainable, repeatable growth?

- How do these scattered projects form a streamlined pipeline that delivers year after year?

The net effect? Executives may find it challenging to justify resource allocations and assure stakeholders that innovation will predictably translate into financial returns. Bridging this gap requires not just better frameworks, but systems and processes that provide clear oversight, accountability, and alignment—ensuring every innovation effort is both visible and value-driven.

Building and Managing a Healthy Innovation Portfolio

Strategic Alignment

The foundation of a healthy innovation portfolio is ensuring that every project aligns with your organization’s overall strategy and long-term goals. This means regularly reviewing your portfolio to confirm that each initiative supports your company’s vision, addresses key market opportunities, and leverages core strengths. Strategic alignment helps prevent wasted resources on projects that don’t fit your business objectives and ensures that innovation efforts drive meaningful results.

Portfolio Development Process

Building a robust innovation portfolio involves a clear, repeatable process:

Set Strategic Objectives:

Define what you want your innovation efforts to achieve, such as entering new markets, improving customer experience, or increasing operational efficiency.Assess Existing Projects:

Audit your current innovation activities to understand where resources are being allocated and identify any gaps.Categorize Initiatives:

Group projects by type (Core, Adjacent, or Transformational) to visualize your portfolio balance.Prioritize and Allocate Resources:

Use criteria like potential impact, feasibility, and alignment with strategy to prioritize initiatives and assign resources accordingly.Monitor and Adjust:

Regularly track project progress and portfolio performance, making adjustments as market conditions and business priorities evolve.

By following this process, organizations can ensure their innovation portfolio remains balanced, strategically focused, and responsive to change.

Tools and Metrics for Portfolio Management

A healthy innovation portfolio relies on the right tools and metrics to ensure transparency, alignment, and measurable progress. Ezassi’s Innovation Pipeline Management platform offers a comprehensive suite of solutions designed to streamline every stage of the innovation process.

Innovation Portfolio Management Tools

Centralized Idea Management- Ezassi’s platform enables organizations to collect, organize, and evaluate ideas in one place, making it easy to prioritize and advance the most promising concepts.

Customizable Pipeline Management- With a flexible Kanban board, teams can visualize the status of each project, track milestones, and allocate resources efficiently. This approach supports a clear stage-gate process, ensuring that only high-potential ideas move forward.

AI-Powered Technology Scouting- Ezassi’s technology discovery tools help identify emerging trends, new technologies, and potential partners, keeping your portfolio ahead of the curve.

Workflow Automation- The platform allows for unlimited, customizable workflows tailored to specific products or categories, providing real-time status updates via an intuitive dashboard.

Collaboration and Task Assignment- Cross-functional teams can collaborate within the platform, with clear task assignments and progress tracking to accelerate innovation delivery.

By leveraging Ezassi’s integrated tools and tracking the right metrics, organizations can manage their innovation portfolios with greater clarity, agility, and confidence ensuring that every initiative contributes to long-term growth and competitive advantage. Contact us for a demo of the platform and to discuss how easily it integrates into an active innovation program.

Conclusion

A 70:20:10 allocation is often cited as a benchmark for a balanced innovation portfolio, but the optimal mix will always depend on your organization’s unique risk profile, market dynamics, and strategic objectives. Organizations that are more risk-averse may lean toward a higher proportion of core innovation, while those seeking transformative growth might allocate more resources to breakthrough or transformational initiatives. Ultimately, there is no universal formula- the healthiest innovation portfolios are those tailored to address specific innovation gaps and evolving business needs, ensuring alignment with long-term growth ambitions.

If you seek advice on Innovation Portfolio strategy, talk to an Ezassi Consultant.