CPG Innovation Is a Billion-Dollar Growth Engine

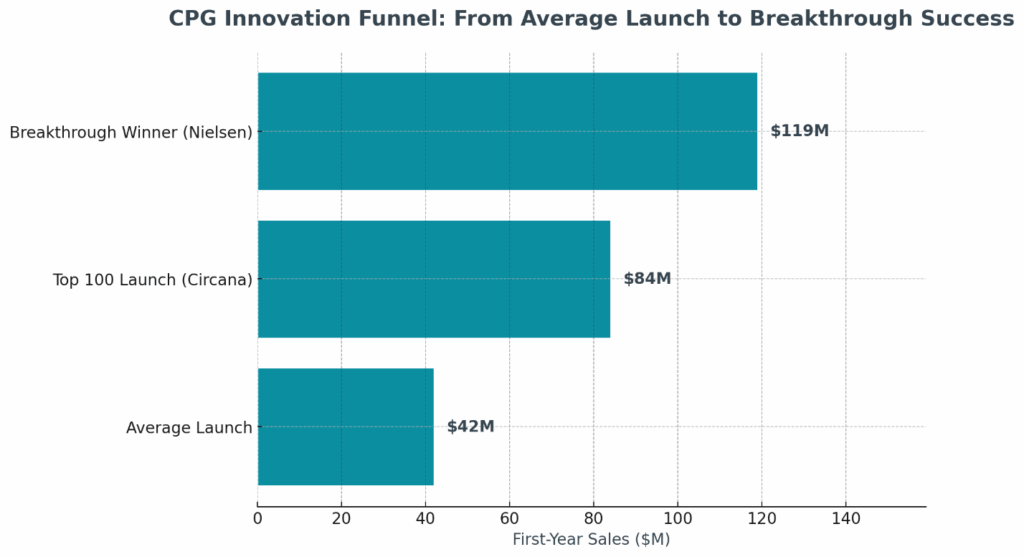

Consumer packaged goods (CPG) innovation consistently delivers massive financial returns. Industry benchmarks from Nielsen and Circana prove that new product launches can quickly scale into nine-figure businesses—if companies capture the right ideas and bring them to market effectively.

- Nielsen Breakthrough winners average $119M in first-year revenue, with sustained performance beyond year two.

- Top 100 CPG launches = $8.4B in first-year sales (Circana New Product Pacesetters).

- Even smaller “base hits”—new SKUs in the $8M–$10M range—can compound into hundreds of millions when launched consistently.

The opportunity is clear: structured ideation and validation dramatically increase the odds of landing the next blockbuster launch.

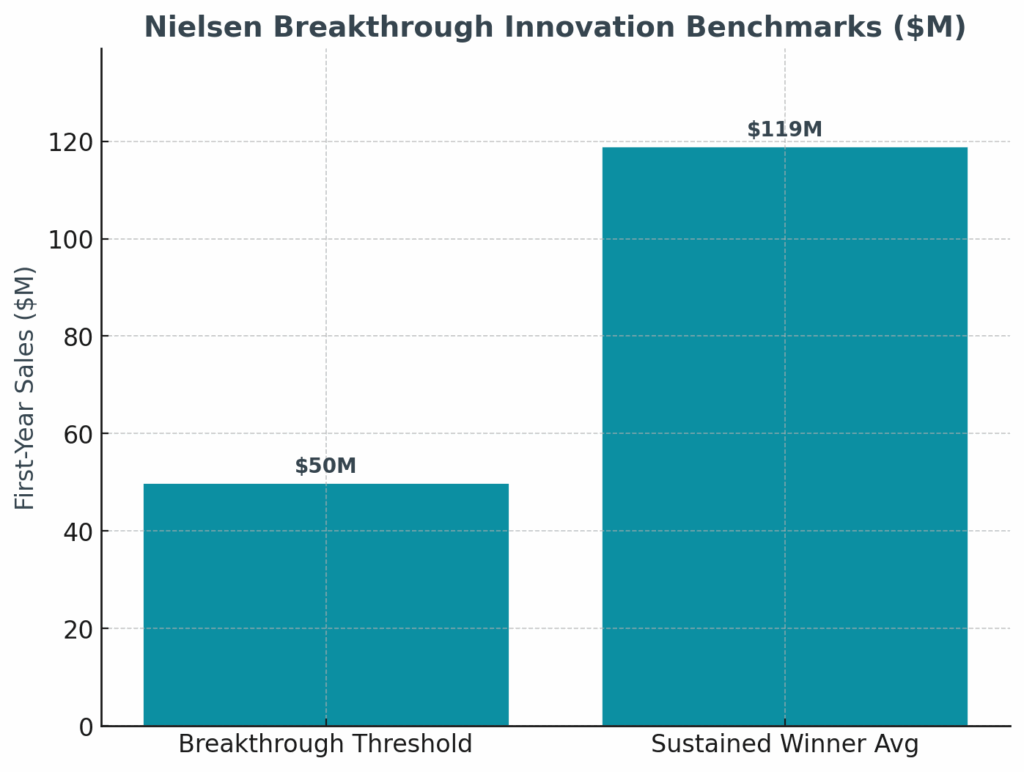

Nielsen Breakthrough Winners: $119M Average Revenue

Who is Nielsen?

Nielsen is one of the most recognized names in consumer and market research and they are considered the scorekeeper for the CPG industry. Founded in 1923, the company originally made its mark by pioneering audience measurement for radio and later television. Today, Nielsen is a global measurement and data analytics firm that helps businesses understand what consumers watch, listen to, and buy.

What Defines a Breakthrough Innovation

Nielsen BASES awards are reserved for products that achieve:

- $50M+ in U.S. retail sales in year one

- At least 90% of sales sustained in year two

These criteria separate true consumer-validated winners from short-lived fads.

The $119M Benchmark

Among qualifying products, the average first-year revenue is $119M—more than double the $50M threshold. That means most winners don’t just squeak by; they become category shapers.

Real-World Examples of Breakthrough Innovation

Recent winners show the diversity of success stories:

- White Claw Hard Seltzer Surge – Built on cultural momentum to expand a category it helped create.

- PRIME Hydration – A challenger brand that quickly scaled into the mainstream.

- GHOST Energy – Tapping into the functional beverage boom with unique branding.

- Dr. Squatch – Redefined men’s personal care with natural ingredients and bold marketing.

- Impossible Burger – A plant-based phenomenon that sparked new habits and conversations.

- Oreo Thins – A legacy brand innovating with portion control and lifestyle-driven formats.

These products didn’t just launch; they sustained loyalty and in some cases, spawned entire categories.

Why It Matters

- Consumer-validated ideas scale fast: Breakthroughs routinely top $100M+ in sales.

- Big and small brands succeed: From P&G and Mondelez to insurgents like PRIME and Yasso.

- Ideation is the common denominator: Structured intake and validation increase the odds of breakthrough success.

With Ezassi’s ideation platform, the conversation shifts from incremental gains to building the next $100M+ product.

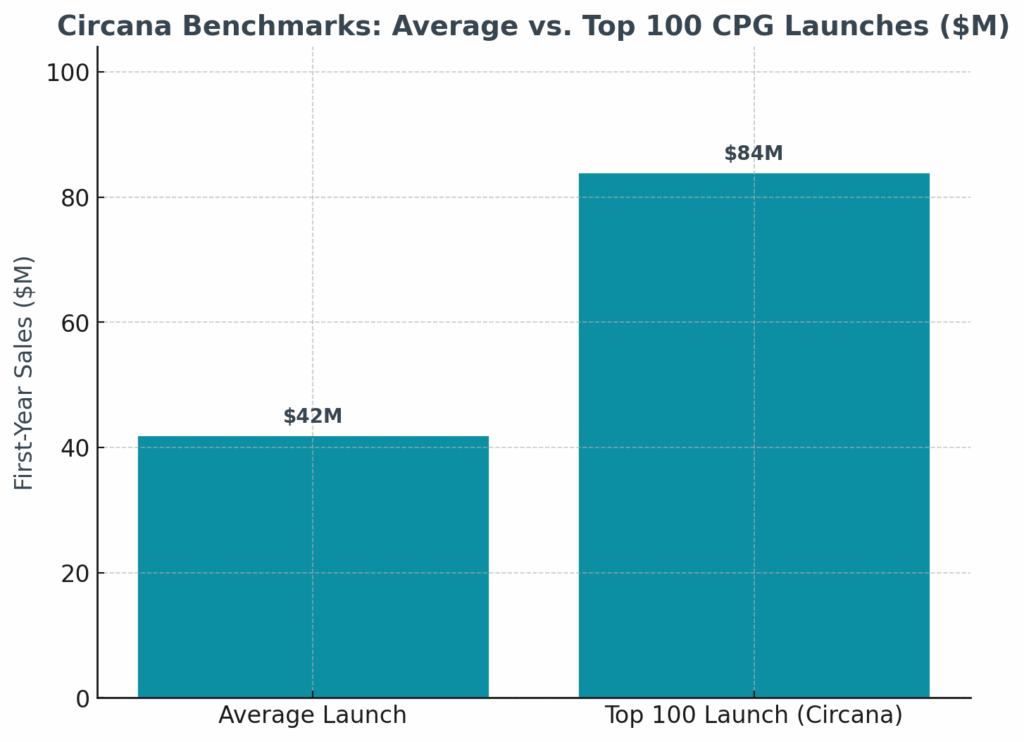

Circana’s Pacesetters: $8.4B in First-Year Sales

Who is Circana and what is the New Product Pacesetter report?

Circana (formerly IRI + NPD) tracks the top 100 U.S. CPG launches each year across food, beverage, household, and personal care. Each year, Circana publishes the New Product Pacesetters report, which identifies the top 100 CPG product launches in the U.S. These are ranked by first-year retail sales across food, beverage, household, and personal care categories. It’s essentially the industry scoreboard for innovation success

In the latest report:

- Top 100 launches collectively generated $8.4B in first-year sales.

- That’s an average of $84M per launch.

- The figure is double the baseline average of $42M for new launches.

Why It’s Persuasive

This data shows:

- Winning launches aren’t outliers—they’re systematic across categories.

- Companies consistently reaching the Pacesetters list are capturing tens of millions in year-one revenue.

- With structured ideation, companies boost their chances of replicating this success.

Who Makes the List? Legacy Giants and Challenger Brands

The Pacesetters list isn’t dominated by the same old companies. Instead, it features a dynamic mix of established leaders and agile newcomers.

Challenger Brands Rising

- In 2023, manufacturers with under $500M in annual sales made up 59% of product count and 43% of Pacesetter dollar sales.

- In 2024, challenger brands maintained strong visibility, while large manufacturers accounted for 32% of products and 64% of sales.

Legacy Brands Holding Strong

- Procter & Gamble continues to dominate categories with products like Charmin Ultra Soft Smooth Tear, Gain + Ultra Oxi, and Swiffer PowerMop.

- Large players such as PepsiCo and Nestlé also make regular appearances, underscoring the value of deep pipelines.

Brand Mix: Examples from 2023 & 2024 Pacesetters

Here are representative winners—across both categories—from the most recent reports:

| Year | Category | Notable Products / Brands |

| 2023 | Food & Beverage | Similac 360 Total Care, PRIME Hydration, Ghost Energy, OREO Frozen Desserts, Doritos/Cheetos Minis, Black Rifle Coffee, Electrolit, Kevin’s Natural Foods |

| Non-Food | Gain+ Odor Defense, Tide Ultra OXI, Raw Sugar, Dr. Squatch, Flamingo, Duke Cannon, Bark, Billie, Downy Rinse & Refresh | |

| 2024 | Food & Beverage | Just Bare Lightly Breaded Chicken, Dr Pepper Strawberries & Cream, C4 Energy, Red Bull Sea Blue, MrBeast Feastables, PRIME Energy, Legendary Foods, Golden Island, Real Good Foods Lightly Breaded Chicken, CELSIUS Essentials |

| Non-Food | Charmin Ultra Soft Smooth Tear (P&G), Cascade Platinum Plus, Hero Cosmetics, Cirkul, Swiffer PowerMop, Lume, Gain + Ultra Oxi (P&G), PrettyLitter, TEMPTATIONS Dry Cat Food, Bloom |

Innovation Themes Driving Success

Across 2023–2024, Pacesetter products often focused on:

- Functional benefits (protein, energy, wellness).

- Convenience formats (ready-to-drink, easy prep).

- Co-branded/licensed products (leveraging fandom or cultural cachet).

- Clean label/minimal ingredients (aligning with evolving consumer values).

What This Tells Us About Ideation Platforms

- Legacy companies prove that internal pipelines and structured innovation deliver results consistently.

- Emerging brands’ wins highlight the power of agile ideation—when great ideas surface, they can break through regardless of size.

- A unified ideation platform levels the playing field, enabling brands of all sizes to systematically capture and act on high-potential ideas—boosting chances of landing on the Pacesetters list themselves.

Why This Matters for Ideation Platforms

The lesson from Nielsen and Circana is clear:

- Breakthrough innovation is possible for both large and small brands.

- Structured ideation pipelines increase the odds of success by turning raw ideas into validated, consumer-ready products.

- A unified ideation platform like Ezassi’s enables companies to systematically capture input from employees, vendors, and customers—leveling the playing field for innovation.